Taiwan announced its second quarter financial report for 2025 today, with a consolidated acquisition of approximately NT$93.37 billion, a pure profit of approximately NT$39.82 billion, and an earnings of RMB15.36 per share (equivalent to US deposit...

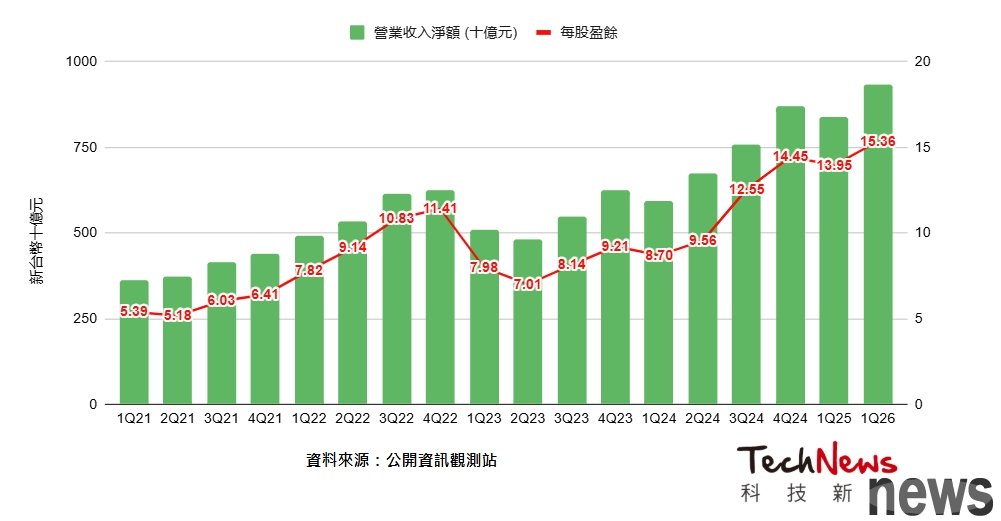

Taiwan announced its second quarter financial report for 2025 today, with a consolidated acquisition of approximately NT$93.37 billion, a pure profit of approximately NT$39.82 billion, and an earnings of RMB15.36 per share (equivalent to US deposit certificates of US$2.47 per unit).

Taiwan Tel pointed out that compared with the same period last year, the second quarter of 2025 increased by 38.6%, and both after tax and earnings per share increased by 60.7%; compared with the previous quarter, the second quarter of 2025 increased by 11.3%, and the second quarter of 2025 increased by 10.2%. All of the above financial figures are combined financial statement numbers and are compiled in accordance with the International Financial Reporting Guidelines (TIFRS) approved by the Financial Control Council.

If calculated in US dollars, the second quarter of 2025 will be 30.07 billion, an increase of 44.4% compared with the same period last year and 17.8% compared with the previous quarter; as for the gross profit margin, it will be 58.6%, the operating rate of interest is 49.6%, and the post-tax pure rate of return is 42.7%.

French quarter outlook for the second quarter, with an estimated closing of USD 28.4 billion to USD 29.2 billion, with a median growth of 13% compared with the previous quarter and a 38% increase in the same period in 2024. Calculated at $1 USD NT$32.5, it is about 923 billion to 949 billion yuan, an increase of 10% to 13% from the first quarter, an increase of 37% to 41% from 2024, a gross profit margin of 57% to 59%, and a profit rate of 47% to 49%. The gross profit margin fell between 57.9% and 59.9%, and the operating interest rate was 47.9% to 49.9%. The number of business income is better than expected, and the gross profit margin and operating interest rate are in line with financial measurement.

Taiwan pointed out that 3-nanometer shipments accounted for 24% of the sales of crystals in the second quarter of 2025, 5-nanometer-process shipments accounted for 36% of the sales of crystals in the whole quarter; 7-nanometer-process shipments accounted for 14% of the sales of crystals in the whole quarter. Overall, advanced processes (including advanced processes of 7 nanometers and more) earned 74% of the sales amount of all season crystal rounds.

Taiwan Electric Financial Director and Spokesperson Huang Renzhao, Deputy General Manager of the Secretariat, said that the performance of Taiwan Power's second quarter of 2025 benefited from the demand for continuous strong AI and high-performance computing (HPC). As the market enters the third quarter of 2025, the strong demand for advanced process technology in the market will continue to support the performance of Taiwan Power's industry.

Looking forward to the third quarter, NTU expected consolidated investment to be between US$31.8 billion and US$33 billion. If the exchange rate of NT$29.0 USD 1 is assumed, the gross profit margin is between 55.5% and 57.5%, and the business profit rate is between 45.5% and 47.5%.