Bank Association President and OCBC President Huang Bijuan believes that integrating the governance of eight national payment systems into Singapore payment network companies can innovate more quickly and effectively to meet the changing payment nee...

Bank Association President and OCBC President Huang Bijuan believes that integrating the governance of eight national payment systems into Singapore payment network companies can innovate more quickly and effectively to meet the changing payment needs of consumers and enterprises.

Director of the HKMA Xie Zhizhen said: "The establishment of Singapore Payment Network Company is an important step in strengthening my country's national payment infrastructure. Doing so will integrate our payment system into a unified governance structure. Singapore Payment Network Company will provide a foundation for banks and payment operators to cooperate more effectively, and can improve the resilience and innovation of Singapore's payment infrastructure."

The HKMA and the Banking Association announced earlier this year that it would establish a new entity that integrates the administration and management of eight national payment systems.

The Monetary Authority of Singapore and the Singapore Banking Association made the above announcement at the 52nd anniversary dinner of the Banking Association on Wednesday (June 25).

In addition, Huang Bijuan announced at the dinner that the HKMA and the Banking Association will launch two electronic deferred payments (EDP) plans - EDP and EDP+ at the end of July.

Talking about the banking industry's efforts to prevent fraud, Huang Bijuan revealed that as of the end of May this year, about 29 billion yuan of customer funds had been "locked" using the Money Lock function.

The HKMA and the Banking Association announced last year that it would launch the above two plans by the middle of this year, with the goal of stopping the use of corporate checks by the end of 2026. Huang Bijuan said: "Everything is going on as scheduled and planned."

The administration and management of eight national payment systems will be integrated into the newly established Singapore Payments Network (SPaN) and is expected to be ready to be put into operation by the end of 2026. Corporate checks will be suspended as scheduled by the end of 2026Singapore Payment Network Company will also form a board of directors, responsible for providing guidance for the company from its establishment to its ready operation, while ensuring that the company has good governance and is aligned with its strategic goals.

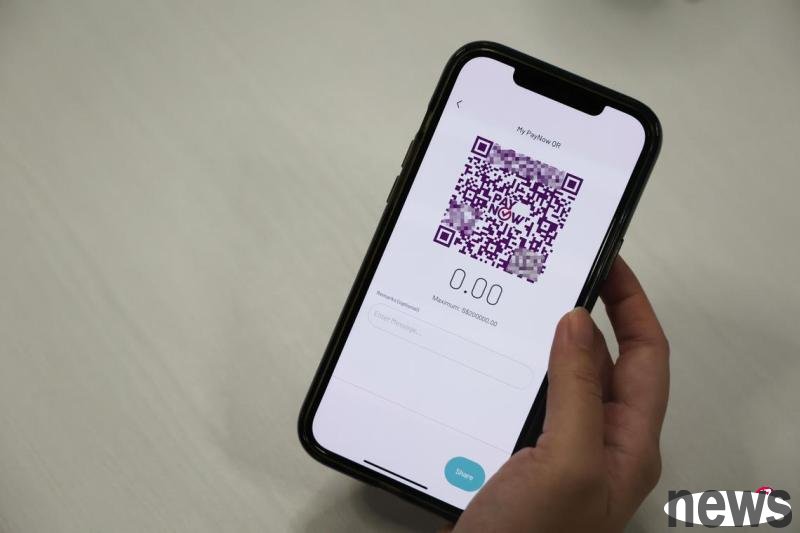

At present, eight payment systems in my country are managed by different institutions. Among them, it includes Fast And Secure Transfers (FAST) and Inter-Bank Giro, managed by the Singapore Clearing House Association (SCHA), PayNow and Electronic Finance (eGIRO), and the National Shared Payment QR Code SGQR managed by the Banking Association, and the HKMA and the Information Communications Media Development Authority (IMDA).

Singapore Payment Network Company is a non-profit guarantee company (Company Limited by Guarantee) jointly established by the HKMA and the Association of Banks. Its initial members include the HKMA and seven domestic systemically important banks. In addition to the three local banks, there are also Citibank, HSBC, Malay Bank and Standard Chartered Bank.

The11 people's board members include two senior representatives from the HKMA, five representatives from banks and non-bank financial institutions, and four independent representatives from the industry.