According to a report by Reuters cited by three people familiar with the matter, China's NAND Flash maker Changjiang Cash (YMTC) is planning to expand its business to the manufacturing of dynamic DRAM chips, which covers products used to make AI...

According to a report by Reuters cited by three people familiar with the matter, China's NAND Flash maker Changjiang Cash (YMTC) is planning to expand its business to the manufacturing of dynamic DRAM chips, which covers products used to make AI-specific memory HBM. Changjiang Cunqian's plan highlights the idea that China is eager to enhance its advanced chip manufacturing capabilities after the United States expands export controls.

The report pointed out that in December 2024, the United States expanded export control measures to limit China's acquisition of HBM. Market insiders and analysts pointed out that this restriction has made the supply problem of HBM chips an increasingly tight issue in China's largest AI chip industry. Because Chinese technology factories including Huawei and ByteDance are actively developing their own AI chips, which makes the domestic demand for HBM more urgent.

In order to meet this demand, Changjiang Cash is developing advanced chip packaging technology using through-silicon via (TSV) technology. Two people familiar with the matter revealed that TSV technology is used to stack DRAM and then produce the core technology of HBM. Currently in the global market, HBM chips are mainly supplied by Micron in the United States, SK Hynix in South Korea and Samsung Electronics. These HBMs are used in AI chips from companies such as NVIDIA (Nvidia) and Ultramicro (AMD). In the Chinese market, Changjiang Cash’s main rival Changxin Cash (CXMT), has been developing HBM chips.

The report pointed out that Changjiang Cunyuan is considering allocating part of the production capacity of a new crystal plant built in Wuhan to future DRAM production. According to company registration information service provider information, Changjiang Cunjian has established a new company earlier this month to promote the construction of its third crystal factory in Wuhan. The new company's registered capital has basically reached a staggering RMB 20.7 billion (about US$2.9 billion). However, the monthly capacity of the new crystal circle factory has not yet been confirmed, nor can it be determined how much capacity will be allocated to the production of DRAM, and Changjiang Subsidy has not further explained it.

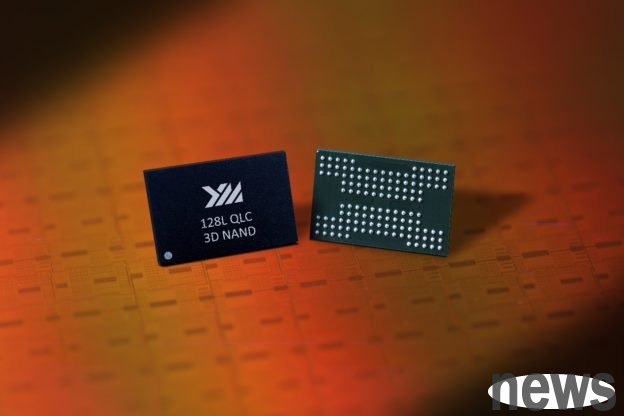

In fact, Changjiang Cash is owned by a national-backed holding company with the same name. The company plays a crucial role in China's efforts to promote NAND Flash's self-sufficiency. In the past, China mainly relied on imports from South Korea, Japan and the United States in this area. After the Changjiang Storage, China began to supply part of its own goods. However, Changjiang Inventor has been included in the physical list of export restricted by the United States in 2022.

At present, Changjiang Cunyi's two existing crystalline factories in Wuhan have always focused on the production of NAND Flash. According to research reports from Morgan Stanley, as of the end of 2024, these factories can produce 160,000 12-inch wafers per month, and are expected to further increase the production of 65,000 wafers in 2025.