US President Donald Trump recently reached a new trade agreement with the EU, reducing the tax on imports from 30% to 15% in Europe, including several strategic products including semiconductor equipment, have received zero tax exemptions. Products...

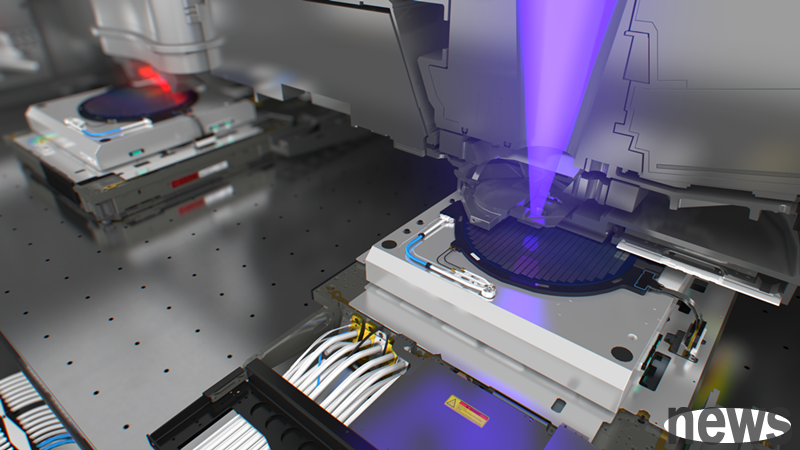

US President Donald Trump recently reached a new trade agreement with the EU, reducing the tax on imports from 30% to 15% in Europe, including several strategic products including semiconductor equipment, have received zero tax exemptions. Products representing ASML, a Dutch semiconductor equipment manufacturer, will not rise in price in the US market, meaning that Taiwan Electricity and the US are welcome to gain more benefits.

The European Commission stated in a statement that it agreed to impose zero-related taxes on a series of strategic products, including all aircraft and their parts, some chemicals, partial imitation medicines, semiconductor equipment, some agricultural products, natural resources and key raw materials, and continue to work to include more products into this list.

The report pointed out that if the United States charges 15% tax on DUV and EUV exposure equipment, measuring tools and detection tools produced by ASML, this will have a serious impact on semiconductor chip manufacturers such as Intel, NTD, Samsung, GF and Texas Meters, clearly pushing up the costs of local chip manufacturers in the United States.

For example, ASML's advanced immersion DUV (ArF) equipment used for process technology below 10nm has an average cost of $89.615 million per unit, while the price of low NA EUV equipment is about $265 million, and the additional 15% tax charge will increase the costs to $103 million and $305 million, respectively.

According to estimates, if the U.S. tax on lithography, measurement and testing equipment for ASML will significantly increase the costs of U.S. chip manufacturers, as each DUV equipment will increase by about $13 million and each EUV equipment will increase by up to $40 million, representing each advanced wafer factory, such as Intel, Samsung, and NTL, in excess of $1 billion in spending.

In fact, due to the appreciation of the Euro dollar since early February this year, the EU-made wafer factory equipment has been more expensive for US chip manufacturers, so the additional 15% tax collection will have a significant impact. Although GF and Texas instruments have not purchased EUV systems, the investment amount of new wafer factories will still be far higher than the original estimate.

Now the United States has implemented tax exemptions for several strategic products within the EU semiconductor equipment, which means that chip manufacturers who have recently visited the U.S. factory will reduce costs due to zero-related equipment taxes, retain the cost-effectiveness of the US crystal factory expansion, and make relevant operators have a relatively happy expectation for the US semiconductor taxes to be announced.

EU fab tool makers get reprieve in EU-U.S. tarriffs deal — ASML and others to be exempted from 15% duty Extended reading: Trump announced that the tax collection for South Korea has been reduced to 15%! South Korea promises to invest $35 billion in the United States Trump announced that 50% tax will be charged on copper starting from 8/1! Tax exemption for all small parcels since 8/29 Taiwan has not yet been revealed! Trump's 25% tax levy on India