The latest quarter-on-quarter (July-September) acquisition of KLA Corporation, a crystal test equipment manufacturer, recently announced, has hit Huaer Street expectation and forecast hot demand for AI processors. The stock price should rise after t...

The latest quarter-on-quarter (July-September) acquisition of KLA Corporation, a crystal test equipment manufacturer, recently announced, has hit Huaer Street expectation and forecast hot demand for AI processors. The stock price should rise after the market.

Reuters and Investing.com reported that Kelei announced its fourth quarter (April-June) financial report after the US stock market on the 31st: the annual closing increase of 24% to US$3.175 billion; the adjusted non-GAAP profit per share reached US$9.38, up from US$6.6 in the same period last year. According to the LSEG survey, analysts generally predict that the non-GAAP profit per share will reach US$3.08 billion and US$8.54.

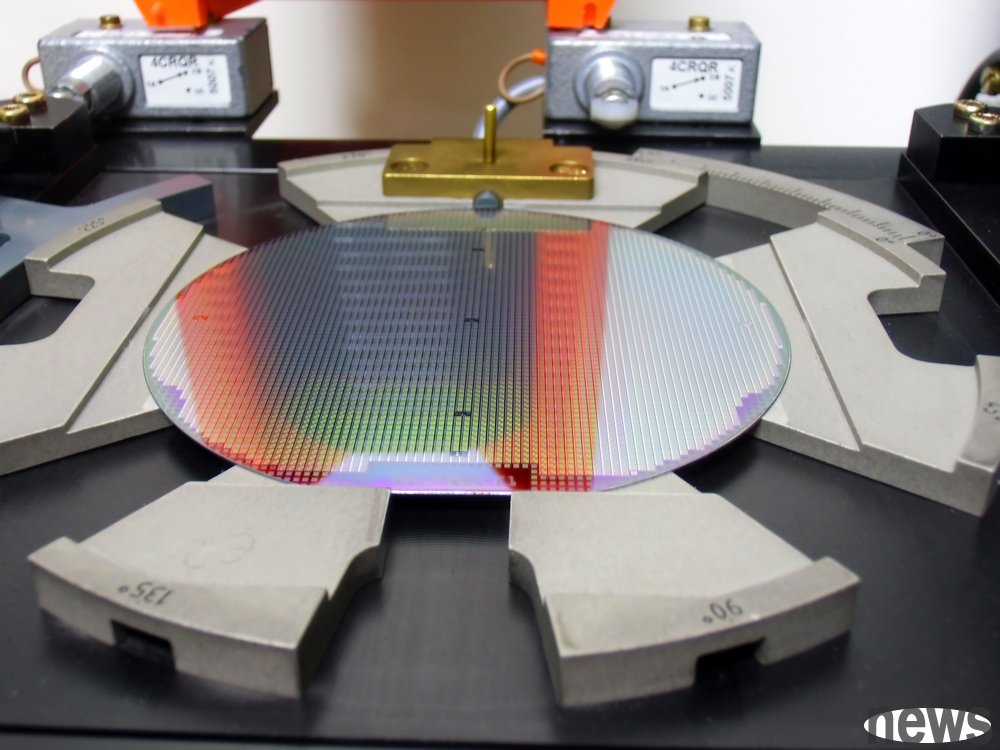

(Source: Kelei)

Kolei said that from April to June, the market's demand for advanced logical ICs, high-frequency wide memory (HBM) and advanced packaging technology has become an important factor in driving harvest growth.

Looking ahead to Q1, Kelei predicts that the closing will reach US$3.15 billion (with an increase of US$15 billion), which is better than the LSEG survey analysts' average valuation of US$3.05 billion; the adjusted Non-GAAP dilute profit per share is expected to reach US$8.53 (with an increase of US$0.77); the Non-GAAP gross profit margin will reach 62% (with an increase of 1 percentage point).

Kelei's important customer Taiwan power supply is being developed in the United States. In the last conference year (ends on June 30, 2024), Taiwan's total investment was paid by Kelei by more than 10%.

Kolei predicted in a letter to shareholders that China's overall demand will be lower this year. From April to June, China's investment in Kelei reached 30%, ranking first in all regions.

Kole fell 4.97% in the normal market on July 31 and closed at $879.03, reaching a new low since June 23; after the market, it slid 1.02% to $887.99.